logistic_guy

Senior Member

- Joined

- Apr 17, 2024

- Messages

- 2,214

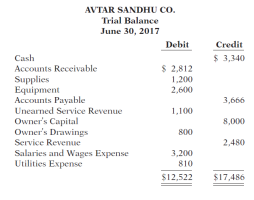

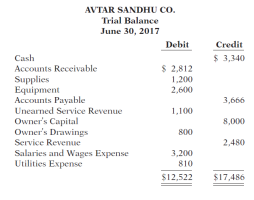

The trial balance of \(\displaystyle \text{Avtar Sandhu Co}\). shown below does not balance.

Each of the listed accounts has a normal balance per the general ledger. An examination of the ledger and journal reveals the following errors.

\(\displaystyle \bold{1}\) Cash received from a customer in payment of its account was debited for \(\displaystyle \$ 580\), and Accounts Receivable was credited for the same amount. The actual collection was for \(\displaystyle \$ 850\).

\(\displaystyle \bold{2}\) The purchase of a computer on account for \(\displaystyle \$ 710\) was recorded as a debit to Supplies for \(\displaystyle \$ 710\) and a credit to Accounts Payable for \(\displaystyle \$ 710\).

\(\displaystyle \bold{3}\) Services were performed on account for a client for \(\displaystyle \$ 980\). Accounts Receivable was debited for \(\displaystyle \$ 980\), and Service Revenue was credited for \(\displaystyle \$ 98\).

\(\displaystyle \bold{4}\) A debit posting to Salaries and Wages Expense of \(\displaystyle \$ 700\) was omitted.

\(\displaystyle \bold{5}\) A payment of a balance due for \(\displaystyle \$ 306\) was credited to Cash for \(\displaystyle \$ 306\) and credited to Accounts Payable for \(\displaystyle \$ 360\).

\(\displaystyle \bold{6}\) The withdrawal of \(\displaystyle \$ 600\) cash for \(\displaystyle \text{Sandhu}\)’s personal use was debited to Salaries and Wages Expense for \(\displaystyle \$600\) and credited to Cash for \(\displaystyle \$ 600\).

Instructions

Prepare a correct trial balance. (Hint: It helps to prepare the correct journal entry for the transaction described and compare it to the mistake made.)

Each of the listed accounts has a normal balance per the general ledger. An examination of the ledger and journal reveals the following errors.

\(\displaystyle \bold{1}\) Cash received from a customer in payment of its account was debited for \(\displaystyle \$ 580\), and Accounts Receivable was credited for the same amount. The actual collection was for \(\displaystyle \$ 850\).

\(\displaystyle \bold{2}\) The purchase of a computer on account for \(\displaystyle \$ 710\) was recorded as a debit to Supplies for \(\displaystyle \$ 710\) and a credit to Accounts Payable for \(\displaystyle \$ 710\).

\(\displaystyle \bold{3}\) Services were performed on account for a client for \(\displaystyle \$ 980\). Accounts Receivable was debited for \(\displaystyle \$ 980\), and Service Revenue was credited for \(\displaystyle \$ 98\).

\(\displaystyle \bold{4}\) A debit posting to Salaries and Wages Expense of \(\displaystyle \$ 700\) was omitted.

\(\displaystyle \bold{5}\) A payment of a balance due for \(\displaystyle \$ 306\) was credited to Cash for \(\displaystyle \$ 306\) and credited to Accounts Payable for \(\displaystyle \$ 360\).

\(\displaystyle \bold{6}\) The withdrawal of \(\displaystyle \$ 600\) cash for \(\displaystyle \text{Sandhu}\)’s personal use was debited to Salaries and Wages Expense for \(\displaystyle \$600\) and credited to Cash for \(\displaystyle \$ 600\).

Instructions

Prepare a correct trial balance. (Hint: It helps to prepare the correct journal entry for the transaction described and compare it to the mistake made.)