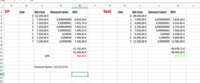

Hi for my uni paper I am currently considering 2 different projects and I am using the Net Present Value and Internal Rate of Return Method to evaluate both projects. I have been spending the last few hours on this and can not seem to find my mistake. For the Net Present Value I am receiving a negative result for Company A and a positive result for company B. However, when utilising the IRR approach I get negative results for both Project A and B. I have attached the Project Stats for A and B as well as my workings in Excel. I really really appreciate anyone's help or advise! Thanks a lot for your time

NVP AND IRR

- Thread starter Mira234

- Start date