logistic_guy

Senior Member

- Joined

- Apr 17, 2024

- Messages

- 2,214

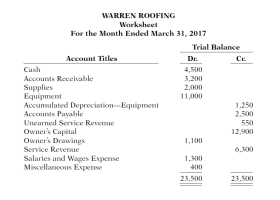

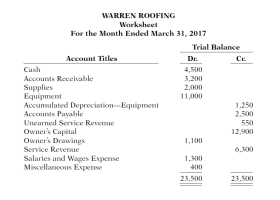

The trial balance columns of the worksheet for \(\displaystyle \text{Warren Roofing}\) at March \(\displaystyle 31, 2017\), are as follows.

Other data:

\(\displaystyle \bold{1.}\) A physical count reveals only \(\displaystyle \$ 480\) of roofing supplies on hand.

\(\displaystyle \bold{2.}\) Depreciation for March is \(\displaystyle \$ 250\).

\(\displaystyle \bold{3.}\) Unearned revenue amounted to \(\displaystyle \$ 260\) at March \(\displaystyle 31\).

\(\displaystyle \bold{4.}\) Accrued salaries are \(\displaystyle \$ 700\).

Instructions

\(\displaystyle \bold{(a)}\) Enter the trial balance on a worksheet and complete the worksheet.

\(\displaystyle \bold{(b)}\) Prepare an income statement and owner’s equity statement for the month of March and a classified balance sheet at March \(\displaystyle 31\). \(\displaystyle \text{T. Warren}\) made an additional investment in the business of \(\displaystyle \$ 10,000\) in March.

\(\displaystyle \bold{(c)}\) Journalize the adjusting entries from the adjustments columns of the worksheet.

\(\displaystyle \bold{(d)}\) Journalize the closing entries from the financial statement columns of the worksheet.

Other data:

\(\displaystyle \bold{1.}\) A physical count reveals only \(\displaystyle \$ 480\) of roofing supplies on hand.

\(\displaystyle \bold{2.}\) Depreciation for March is \(\displaystyle \$ 250\).

\(\displaystyle \bold{3.}\) Unearned revenue amounted to \(\displaystyle \$ 260\) at March \(\displaystyle 31\).

\(\displaystyle \bold{4.}\) Accrued salaries are \(\displaystyle \$ 700\).

Instructions

\(\displaystyle \bold{(a)}\) Enter the trial balance on a worksheet and complete the worksheet.

\(\displaystyle \bold{(b)}\) Prepare an income statement and owner’s equity statement for the month of March and a classified balance sheet at March \(\displaystyle 31\). \(\displaystyle \text{T. Warren}\) made an additional investment in the business of \(\displaystyle \$ 10,000\) in March.

\(\displaystyle \bold{(c)}\) Journalize the adjusting entries from the adjustments columns of the worksheet.

\(\displaystyle \bold{(d)}\) Journalize the closing entries from the financial statement columns of the worksheet.