Shreethini

New member

- Joined

- Apr 4, 2020

- Messages

- 14

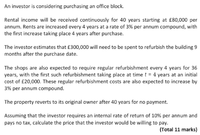

What/which equations were you taught to calculate internal rate of return of an investment?Could anyone please help on how to go on with the problem to solve this question, which I can't get my head around. Would really appreciate your help, thank you!

View attachment 17661

My understanding of this: n=40, D=10%, i(1)= 3%, i(2)=3%Please follow the rules of posting in this forum, as enunciated at:

https://www.freemathhelp.com/forum/threads/read-before-posting.109846/#post-486520

Please share your work/thoughts about this assignment.

View attachment 17662

You have listed the "given" variables and their values.My understanding of this: n=40, D=10%, i(1)= 3%, i(2)=3%

However, I do not understand how to analyse the question

SubhotoshYou have listed the "given" variables and their values.

However, I had asked you to tell me:

What is the definition of internal rate of return (IRR)?

What equation/s have you been taught to calculate IRR?

OK This is a good start. But you need to reduce these to present values, no? And you have to do it for all the cash flows, positive and negative. This will become very tedious without developing a spreadsheet. Moreover, you cannot do it at all with out answering my previous question about what you mean by "continuously." I suspect it really means at regular but finite intervals, but no one so far knows what the intervals are or even if that interpretation is correct.

Do you mean to use the equation Present Value=integrate(b,a) of p(t)v(t)dt. I am not aware of using spreadsheet to calculate anything. "continuously" I believe refers to the rental income of 40 years continuously and the type of equation to use. This interpretation could be wrongOK This is a good start. But you need to reduce these to present values, no? And you have to do it for all the cash flows, positive and negative. This will become very tedious without developing a spreadsheet. Moreover, you cannot do it at all with out answering my previous question about what you mean by "continuously." I suspect it really means at regular but finite intervals, but no one so far knows what the intervals are or even if that interpretation is correct.

I was hoping that the student would respond with something equivalent to:Subhotosh

Internal rate of return is, as I am sure you are aware, a well defined term in the mathematics of finance. As you also undoubtedly know, it may have no closed form solution, and it may have multiple solutions. However, as I read this problem, there is no need to calculate the internal rate of return because it is given as 10%. Instead the student is being asked to show that the concept is understood. That makes me reluctant to respond to the question much beyond what tkhunny has already said.

I believe the limit is 40, if I'm not wrong"Received continuously" is only a slight computational complication. Let's test your mettle.

[math]Annual Payment = AP = 80000[/math][math]i = 0.10[/math]

PV if received at the end of one year:

[math]v = \dfrac{1}{1+ i},\;PV =AP\cdot v[/math]

PV if received at the end of each month:

[math]j = \dfrac{i}{12},\;v = \dfrac{1}{1+ j},\;PV =\dfrac{AP}{12}\cdot(v + v^{2} + ... + v^{12}) = \dfrac{AP}{12}\cdot\dfrac{v - v^{13}}{1-v}[/math]

PV if received at the end of each week:

[math]j = \dfrac{i}{52},\;v = \dfrac{1}{1+ j},\;PV =\dfrac{AP}{52}\cdot(v + v^{2} + ... + v^{52}) = \dfrac{AP}{52}\cdot\dfrac{v - v^{53}}{1-v}[/math]

PV if received at the end of each day:

[math]j = \dfrac{i}{365},\;v = \dfrac{1}{1+ j},\;PV =\dfrac{AP}{365}\cdot(v + v^{2} + ... + v^{365}) = \dfrac{AP}{365}\cdot\dfrac{v - v^{366}}{1-v}[/math]

PV if received at the end of each hour:

[math]j = \dfrac{i}{8760},\;v = \dfrac{1}{1+ j},\;PV =\dfrac{AP}{8760}\cdot(v + v^{2} + ... + v^{8760}) = \dfrac{AP}{8760}\cdot\dfrac{v - v^{8761}}{1-v}[/math]

What is the limit of this process?

Please try that again. Calculate those given. At the very least, when multiplying by 80,000, we won't get anything anywhere near 40.I believe the limit is 40, if I'm not wrong

I thought you meant the limit of how many years we have to calculate it for. Do I need to calculate all of this in order to get the estimate of price investor would be willing to pay?Please try that again. Calculate those given. At the very least, when multiplying by 80,000, we won't get anything anywhere near 40.

1: 80000/1.1 = 72727.27

2: 40000/1.05^2 + 40000/1.05 = 74376.42

4: 20000/1.025^4 + 20000/1.025^3 + 20000/1.025^2 + 20000/1.025 = 75239.48

etc...

See the value sneaking up? Sneaking up to what? This is what is mean by the PV of a value received continuously.

I tend to know the definition, but I don't really understand the process of how to take in the question and go onto using the correct equation.You see - this is why I had requested definitions.

Sorry, what I mean by estimate is calculating the price the investor is willing to pay as the question asks.No. There is no room for "estimate". This just just how to calculate the PV of the continuous payments.

Do you know the following formula?I thought you meant the limit of how many years we have to calculate it for. Do I need to calculate all of this in order to get the estimate of price investor would be willing to pay?

| = | value at time t | |

| = | original principal sum | |

| = | nominal annual interest rate | |

| = | length of time the interest is applied |