Hello to everyone I need help to figure out how to pricing items.

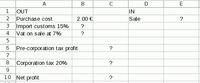

I purchase chemicals from another country and import to where I live now, I buy for x price and resell locally for y price, one full container is made of different chemicals drum with different purchasing cost and different selling price, also different % of customs import tax .Example

price that I purchase one kg of one chemical is 2 euro including transport cost , once arrive I have to pay 15% of this 2 euro for import cost customs tax etc , then is on my warehouse waiting my clients to order, example this chemicals I want to sell and have 70% net income but I need to pay 20% tax on the profit at the end of the year and 7% vat every month based on the income of each chemicals I sell every month. Thanks all

I purchase chemicals from another country and import to where I live now, I buy for x price and resell locally for y price, one full container is made of different chemicals drum with different purchasing cost and different selling price, also different % of customs import tax .Example

price that I purchase one kg of one chemical is 2 euro including transport cost , once arrive I have to pay 15% of this 2 euro for import cost customs tax etc , then is on my warehouse waiting my clients to order, example this chemicals I want to sell and have 70% net income but I need to pay 20% tax on the profit at the end of the year and 7% vat every month based on the income of each chemicals I sell every month. Thanks all